August 2025

At Ware Realty Group (WRG), we know commercial real estate is about more than data – it’s about seeing the patterns, timing the play, and staying attuned to neighborhood-level shifts. In this issue, we spotlight Chatham, where historic architecture, anchored retail, and active residential movement are shaping how investors and developers engage the South Side. We break down trends in pricing, absorption, and property type performance to offer key insights without the noise. Want a deeper dive into Chicago’s broader industrial, retail, and office markets? We’ve linked to our latest updates online. Plus, don’t miss WRG’s new tools, including an AI-powered certification assistant built to save time and simplify the process for small business owners. Whether you’re analyzing market fit or rethinking your investment strategy, this is your intel drop.

COMMUNITY SPOTLIGHT

A pulse of Chicago’s neighborhoods. One by one, we’ll explore data, trends and insights into these localized markets and how they compare to the Chicago market.

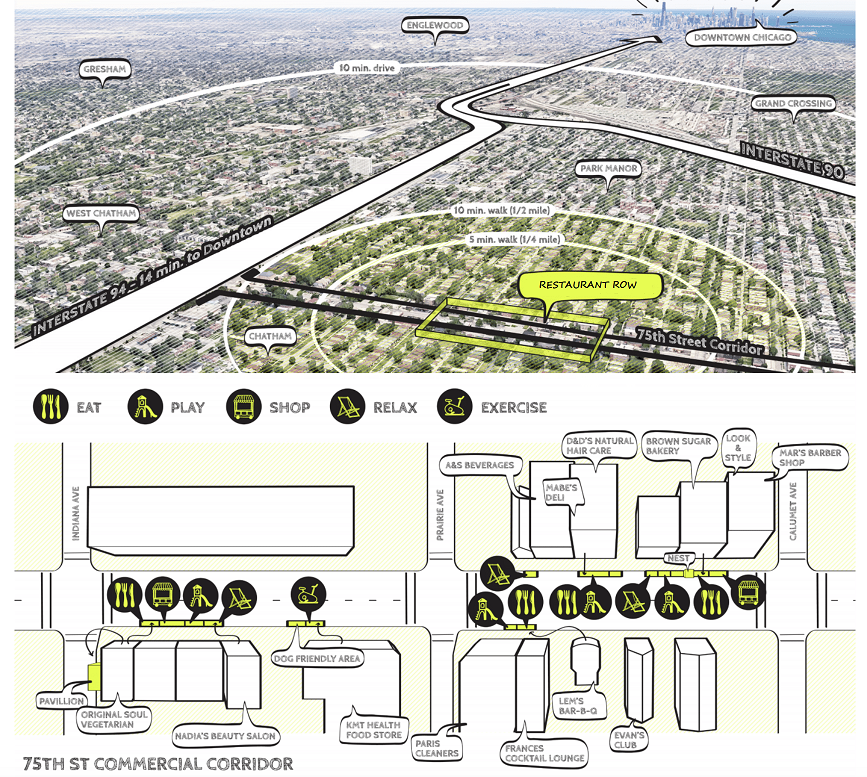

Located on Chicago’s South Side, Chatham is a historically Black neighborhood with deep cultural roots, a legacy of Black homeownership and entrepreneurship, and a strong sense of community pride. It’s also home to some of the city’s distinctive architecture: the Commercial District features well-preserved terra-cotta facades, the Bungalow District includes more than 250 classic Chicago bungalows, and the Garden Homes District showcases a rare collection of century-old homes designed to promote homeownership and green space.

Chatham’s commercial corridors, like 75th Street’s Restaurant Row, Cottage Grove and 79th Street, offer a vibrant mix of long-standing eateries, small businesses, investment opportunities, and institutions like the Greater Chatham Initiative that work to revitalize commercial activity.

Anchored by community institutions and redevelopment efforts, Chatham blends residential charm with commercial potential, making it a neighborhood of both historical significance and ongoing real estate interest.

We’re sharing a summary of key real estate insights from the Chatham neighborhood (Jan–July 2025), based on the latest MRED and CoStar reports. This quick overview is perfect for investors, brokers, and developers looking to stay informed without diving into all the numbers.

Residential Snapshot: Detached Single-Family Homes

- Sales volume is steady with 71 homes sold Jan–June and 104 total through July 12th, despite market fluctuations.

- Median sale prices bounced between $145K–$250K, averaging $225K, with a recent high of $252K in June.

- Average market time for sales: 105 days, indicating buyer hesitancy or pricing misalignment.

- Inventory remains active with 76 listings, mostly 3- to 4-bedroom homes, averaging $231K list price and 138 days on market.

Insight: Price-sensitive buyers are most active below $250K. Sellers overpricing are seeing longer time on market or expiration.

Multi-Unit and Investment Properties

- Two to Four Units:

- 71% sold rate with average sale price of $321K.

- 5+ unit buildings average $570K list price, with 70% sold at ~$607K, showing healthy investor interest.

- Retail/Mixed Use:

- Limited activity but high pricing volatility. Active listings average $675K (Retail) and $327K (Mixed Use) with long market times (139–186 days).

- Expiration rates are high, indicating possible misalignment between asking prices and investor expectations.

Insight: Larger multifamily assets are seeing stronger traction than smaller buildings or mixed-use retail suggesting a tilt toward rental yield over speculative retail use.

Market Dynamics

- Active inventory (as of July 12th): 88 properties with median list price of $240K and average of 160 days on market.

- Under contract: 46 listings averaging 122 days on market, median price $230K.

- Expired listings: 23 listings averaged 376 days, median list price $205K. A clear sign of pricing fatigue and sluggish absorption for misaligned listings.

Insight: Homes priced $150K–$300K move fastest. Properties over $350K face headwinds without upgrades or unique value.

Strategic Takeaways for CRE Professionals

- Detached single-family homes remain the dominant product, but attached units and 2–4 unit buildings show room for growth with the right pricing.

- Buyers are active but deliberate. Pricing to market and reducing time on market is key to movement.

- Investors should monitor the small but active multifamily segment and consider strategic renovations or conversions for long-hold potential.

- Retail and mixed-use owners may need to revisit pricing and marketing strategy given long market times and high expiration rates.

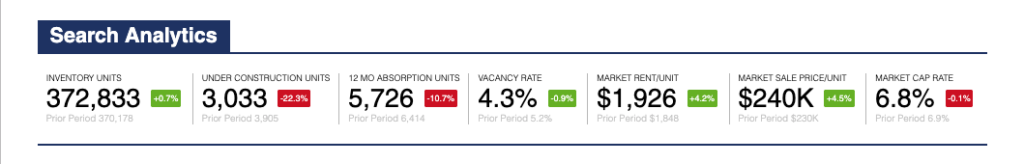

City-wide, here is a summary of key real estate insights from across Chicago’s commercial sectors, drawn from the latest Q2 2025 CoStar market reports. This quick snapshot is designed for investors, brokers, and developers who want timely, relevant takeaways without digging through the full data. You do want to dig through the data though? Click the image below to access the full report.

Multifamily Market

Rent growth moderating, but fundamentals strong.

- Occupancy hovers around 94.5%, consistent with pre-pandemic averages.

- Rent growth is 3.5% YOY, a healthy slowdown from the double-digit gains of 2022–2023.

- New supply (especially luxury units downtown) is being absorbed, though concessions are re-emerging in select submarkets.

- Suburban assets with proximity to transit are outperforming urban high-rises.

Investors are cautious but long-term bullish, particularly on workforce housing and transit-oriented developments.

Want more? Click here for data on industrial, office and retail markets.

GO

The C5 + CCIM Summit is where top players in commercial real estate talk deals, capital, and what’s next for the industry. Hosted by NAR, it’s where commercial real estate meets opportunity. Meet me there Sept 16-18 in Chicago.

LISTEN

CBRE’s “The Future Is Now” explores how AI, data, and innovation are transforming commercial real estate. From smart buildings to predictive insights, this episode dives into what’s next and how to stay ready.

READ

Looking for fresh ideas in affordable housing? This ULI roundup features 10 innovative developments that blend design, equity, and sustainability; offering inspiration for what’s possible in communities like ours.

OUR TEAM IS GROWING!

Todd Mayfield

Associate Broker

Eli Marsh

VP of Operations & Strategy

Ellen Risse

Business Support Specialist

Cary Steve Gando

Multimedia Specialist

I’m SarAI, Sarah’s avatar, assistant, thought partner and AI specialist. AI platforms and tools surround us; they are part of our business ecosystems that may be leveraged to free up time, to streamline workflows and to increase our business successes. How have you integrated AI into your business?

Featured AI Tool

Sarah’s Business Certification Guide (ChatGPT GPT)

This customized GPT helps business owners navigate the often overwhelming process of M/W/DBE certification. From document prep to application tips, it provides instant, tailored guidance anytime you need it.

Why We Created This Tool

At WRG, we know that certification can unlock opportunities, and that getting there isn’t always clear or simple. We created this AI-powered guide to make the process more accessible, especially for entrepreneurs who are managing everything on their own. It’s like having Sarah’s insights in your pocket.

Until next quarter,

Sarah L. Ware

Principal and Designated Managing Broker

MBE, WBE, DBE, WBENC

Licensed in IL and GA

Immediate Past President, Chicago Association of REALTORS

Commercial Real Estate, Market Research, Consulting